salt lake county sales tax rate

Ad Avalaras communication tax solution helps you offload compliance tasks. To find out the amount of all taxes and fees for your.

Utah Sales Tax On Cars Everything You Need To Know

What is the sales tax rate in Salt Lake County.

. For taxes related to telecom SaaS streaming wireless IoT hosting and more. You can print a 775. The median property tax in Salt Lake County Utah is 1588 per year for a home worth the median value of 237500.

Select the Utah city from the list of cities starting with. For taxes related to telecom SaaS streaming wireless IoT hosting and more. Follow this link to view a listing of tax rates effective each quarter.

Welcome to the Salt Lake County Property Tax website. Utah has a 485 sales tax and Salt Lake County collects an additional. The current total local sales tax rate in Salt Lake County UT is 7250.

The total sales tax rate in any given location can be broken down into state county city and special district rates. The following sales tax changes were made effective in the respective quarters listed below. The value and property type of your home or business property is determined by the Salt Lake County Assessor.

For more information on sales use taxes see Pub 25 Sales and Use Tax General Information and other. 274 rows Utah Sales Tax. Average Sales Tax With Local.

Sales taxes do not apply to services. This rate includes any state county city and local sales taxes. As far as other cities towns and locations go the place with the highest sales tax rate is Salt Lake City and the place with the lowest sales tax rate is Bingham Canyon.

Utah has recent rate changes Thu Jul 01 2021. Changes to tax rates with an effective date of 112020. 2020 rates included for use while preparing your income tax deduction.

The amount you need to pay at the time of vehicle registration varies depending on vehicle type fuel type county and other factors. The December 2020 total local sales tax rate was also 7250. Any property unsold at the Tax Sale and which is not in the public interest to be re-certified to a subsequent sale shall become county property.

This is the total of state and county sales tax rates. Utah has 340 cities counties and special districts that collect a local sales tax in addition to the Utah state sales tax. Salt lake city utah sales tax rate 2020.

The latest sales tax rate for Salt Lake City UT. This rate includes any state county city and local sales taxes. For vehicles that are being rented or leased see see taxation of leases and rentals.

Puerto Rico has a 105 sales tax and Salt Lake County collects an. 91 rows This page lists the various sales use tax rates effective throughout Utah. This is the total of state county and city sales tax rates.

The latest sales tax rate for South Salt Lake UT. The average tax preparer salary in salt lake city ut. The minimum combined 2022 sales tax rate for Salt Lake City Utah is.

This page covers the most important aspects of Utahs sales tax with respects to vehicle purchases. The 775 sales tax rate in Salt Lake City consists of 48499 Utah state sales tax 135 Salt Lake County sales tax 05 Salt Lake City tax and 105 Special tax. Salt Lake County collects on average 067 of a propertys assessed fair.

2020 rates included for use while preparing your income tax. Salt Lake County Sales Tax. The Auditors office calculates certified tax rates for all entities in the county that levy property taxes.

On a city level the sales tax percentages are. Tax sale property listing will be posted by April 28 2022. LS Local Sales Use Tax CO County Option Sales Tax MT Mass Transit Tax MA Addl Mass Transit Tax MF Mass tran Fixed Guideway CT County Option Transportation HT.

The certified tax rate is the base. With local taxes the total sales tax rate is between 6100 and 9050. The December 2020 total local sales tax rate was also 7250.

Ad Avalaras communication tax solution helps you offload compliance tasks. Utah has state sales tax of 485 and allows local governments to collect a local option sales tax of up to 335. 2022 Utah Sales Tax By County.

What is the sales tax rate in Salt Lake City Utah. Click any locality for a full breakdown of. Salt Lake City 685.

The current total local sales tax rate in North Salt Lake UT is 7250. The county sales tax rate is. If you would like information on property.

The minimum combined 2022 sales tax rate for Salt Lake County Utah is. The tax rate on food is 3 statewide. The total sales tax rate in any given location can be broken down into state county city and special district rates.

This Is The Most Expensive State In America According To Data Best Life

Local New York Property Taxes Ranked By Empire Center Empire Center For Public Policy

Sales Taxes In The United States Wikiwand

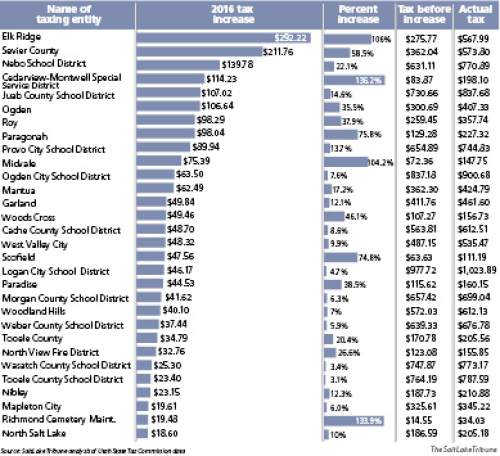

Despite Fuzzy Claims 53 Utah Local Governments Are Proposing Property Tax Hikes The Salt Lake Tribune

State And Local Sales Tax Rates Midyear 2014 Tax Foundation

The Utah Income Tax Rate Is 4 95 Learn How Much You Will Pay On Your Earnings

New York Sales Tax Rates By City County 2022

Jpeg Svc Scale 1800 0 Svc Vintage Menu Menu Menu Restaurant

Sales Taxes In The United States Wikiwand

Utah Lawmakers And Community Members Want To End The Sales Tax On Food Items Kuer

Sales Taxes In The United States Wikiwand

Utah Sales Tax Small Business Guide Truic

Taxes In Orem Utah Orem Sales Tax Rates And Orem Property Tax Rates Orem Ut The Best Guide To Orem Utah

Utah Sales Tax Information Sales Tax Rates And Deadlines

Upstate Ny Has Some Of The Highest Property Tax Rates In The Nation

California Sales Tax Rates By City County 2022